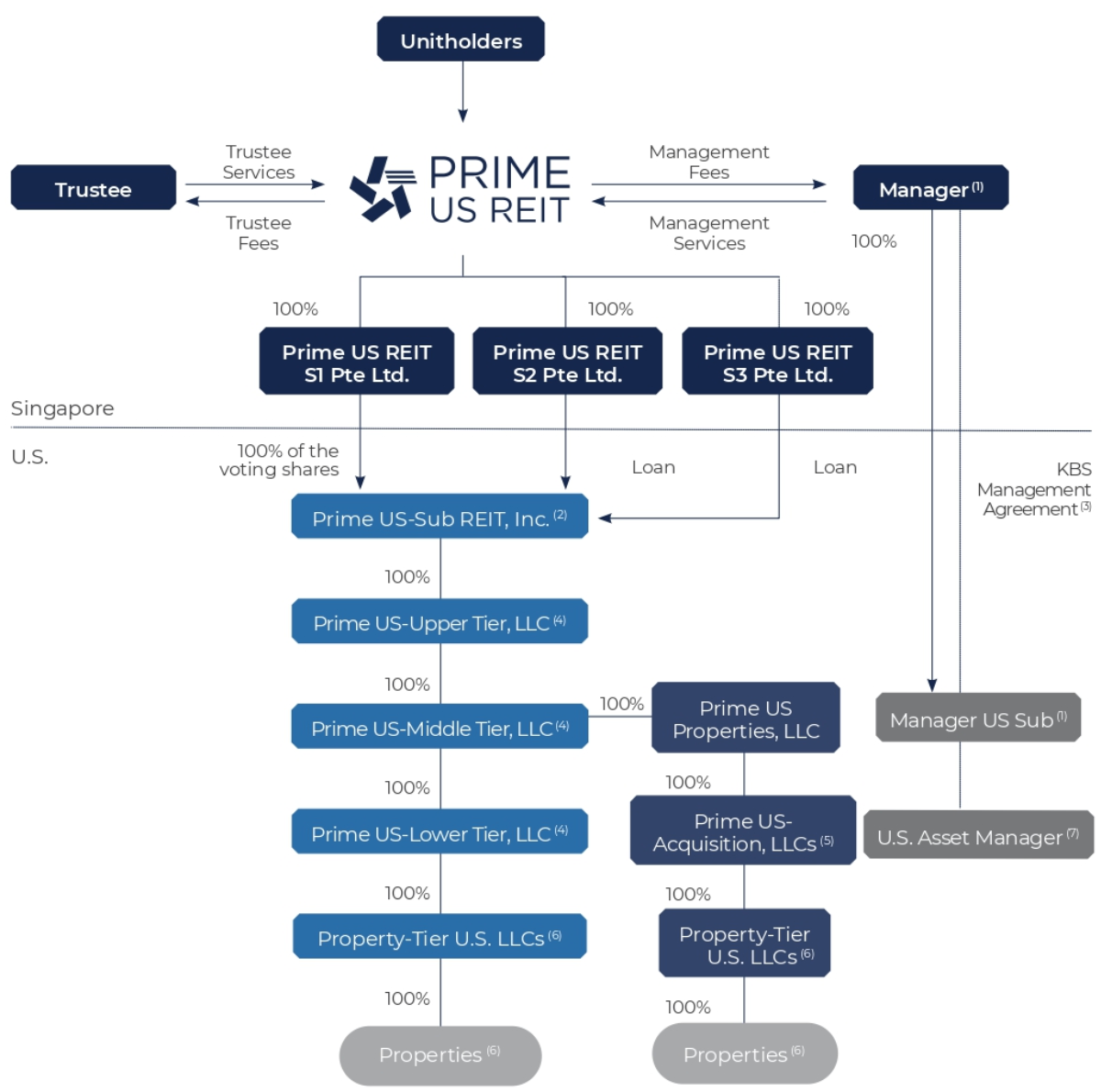

REIT Structure

- The Manager wholly owns the Manager US Sub. The Manager has organised the Manager U.S. Sub such that to the extent activities of the Manager, including those under the KBS Management Agreement, are required to be performed within the U.S., those activities will be delegated to the Manager U.S. Sub.

- 125 preferred shares have been issued by Prime US-Sub REIT, Inc. ("Parent U.S. REIT") to parties who are not related to the Sponsor with a coupon of 12.5%. The preferred shares are non-voting, non-participating and redeemable at the option of Parent U.S. REIT. The terms of the preferred shares are in accordance with customary terms offered to other accommodation shareholders (which are third party holders required to meet the 100 shareholder test) for U.S. REITs in the U.S.. The Certificate of Incorporation for Parent U.S. REIT contains provisions that ensure that this 100 shareholder requirement is continuously met at all times as required under U.S. tax rules applicable to U.S. REITs.

- An agreement entered into between the Manager, the Manager US Sub, the U.S. Asset Manager, the Parent U.S. REIT and the Property Holding LLCs.

- For the avoidance of doubt, there will only be one Upper-Tier U.S. LLC, one Middle-Tier U.S. LLC and one Lower-Tier U.S. LLC.

- Each Acquisition LLC holds one Property-Tier U.S. LLC.

- Each Property will be held by an individual Property-Tier U.S. LLC.

- For the avoidance of doubt, KBS Realty Advisors ("KBS RA") is not a subsidiary of the Manager, and KBS RA does not hold any shares in the Manager (whether directly or indirectly) and vice versa.

As at the date of this Annual Report, PRIME is in compliance with the relevant tax laws and regulations for its relevant subsidiaries and associates to qualify as a real estate investment trust for U.S. federal income tax purposes.

Unitholders and all other persons are prohibited from directly or indirectly owning in excess of 9.8% of the outstanding units, subject to any increase or waiver pursuant to the terms of the Trust Deed and on the recommendation of the Manager.